• Internal control system’s quality assurance.

• Enhanced due diligence of various factors increasing ML/TPF and sanctions risks, as well as drafting the assessment reports.

• Advisory related to compliance with AML/CTPF and sanctions regulations.

• Support and/or representing the client during the independent AML/CTPF reviews carried out by the competent supervising institutions.

• One place solution for fulfilment of all requirements related to KYC.

• Checking for matches against sanctions lists, including daily checks using API (Application Programming Interface).

Due diligence of the client and their business partner before commencement of business relationship and at any further stage.

• Transaction monitoring for the particular period of time, including identification of economic essence of the transaction.

• Detecting and investigating suspicious transactions.

• Developing training materials related to prevention of possible violations in the field of ML/TPF and sanctions.

• Carrying out the training sessions.

• Assessment of negative information (adverse media) related to possible crimes in the field of ML/TPF

• Assessment of other types of information that can cause financial or reputation risk.

Checking the client and their business partner for matches in sanctions lists at any stage of business relationships.

• Compliance of the subject of the law with the established definition of such according to the AML/CTPF law.

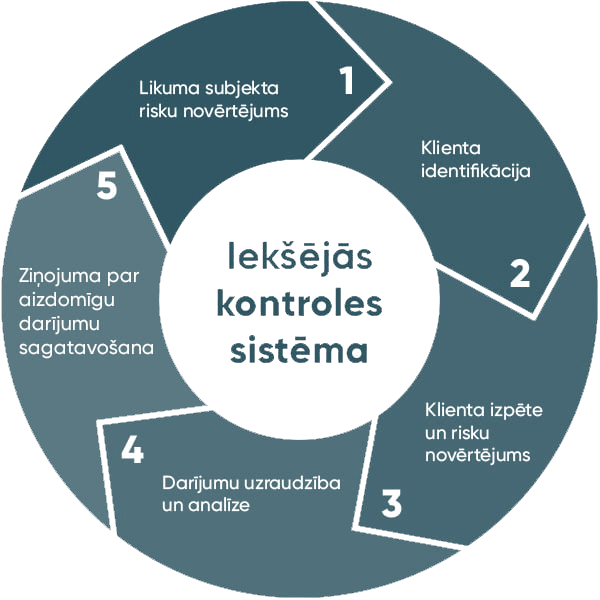

• Assessment of risks of the subject of AML/CTPF Law and Sanctions Law.

• Development, implementation and maintenance of internal control system.

Developed within 10 working days, taking into account the business activity and its specifics. Documents included:

Policy, rules, criteria rules:

Assessment:

Forms:

Developed within 10 working days, taking into account the business activity and its specifics. Documents included:

Policy, rules, criteria rules:

Assessment:

Forms:

Due Diligence of natural persons and legal entities:

The following documents are included:

The following documents are included:

An evaluation system that can be added to the client's pre-developed ICS.

Annual employee training in AML/CTPF and sanctions

Assessment of the Internal Controls compliance with the legal framework requirements of AML/CTPF and sanctions

The customer’s/business partner’s Due Diligence at any stage of the business relationship

Evaluation of the AML/CTPF responsible employee, Assessment of ML/TPF and sanctions risks, Internal Controls, Customer Due Diligence, Training, Consultations